The ongoing Covid-19 pandemic is likely to prove one of the costliest developments in history, likely costing between $1 trillion and $2 trillion, according to United Nations and other estimates.

Like most industries, those engaged in business-to-business (B2B) sales are identifying new ways to conduct their business, including remote and other means of communicating, until such time as the pandemic ends.

Over the past decade, the B2B sales industry has changed in six other substantial ways, according to the findings of our survey of 400 senior executives at large and medium-sized companies who generously shared their insights.

This article addresses these six new realities in B2B sales and analyzes how the best companies are upgrading their organizational structures to leverage them.

1. Multi-sourcing is the new rule

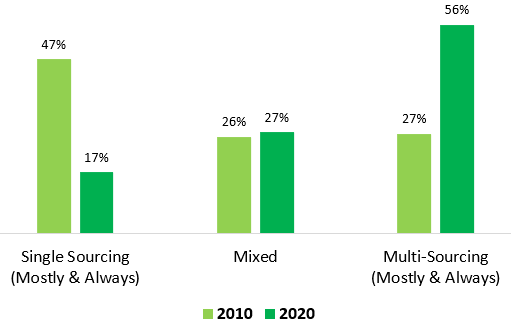

At large and medium-sized companies, multi-sourcing now surpasses single-sourcing for buying products and services.

Ten years ago, however, only 27 percent of these companies were multi-sourcing . Today that number has more doubled, to 56 percent:

What is the prevalence of multi-sourcing versus single-sourcing

of your product/service among your major clients?

Large companies rely on alternative suppliers to minimize their vendor dependence and optimize buying terms.

While this survey predated the Covid-19 pandemic, disruptions caused on supply chains by it, serve only to amplify this trend.

To compete more effectively with major competitors, vendors also have introduced new functional roles.

New positions such as VP Customer On-Boarding, VP Customer Experience, VP Data or VP Supply Chain are now more commonly found in these companies’ organizational charts.

2. Quick sales are vanishing

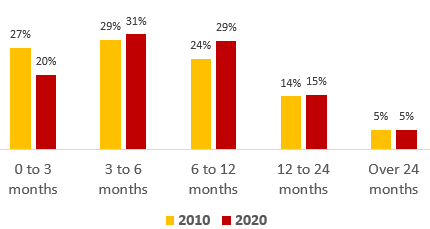

The number of months to close a major sale from a new prospect has increased 14 percent from seven months in 2010 to eight months in 2020.

Here are the responses to the questions we presented related to the closing of sales:

What is the time to close a major sale in months from a new prospect?

Quick sales (zero to three-months) have dropped 26 percent and are being mostly replaced by lengthier six to nine-month sales processes.

Since large B2B deals typically have more competitors and take more time to close, vendors have elevated roles such as VP Key Accounts and VP Business Development to the top of their organizational structures over the past decade.

New senior roles also have been created, such as VP Customer Engagement, VP Business Growth and VP Business Intelligence.

3. Fifty per cent more functions participate in buying

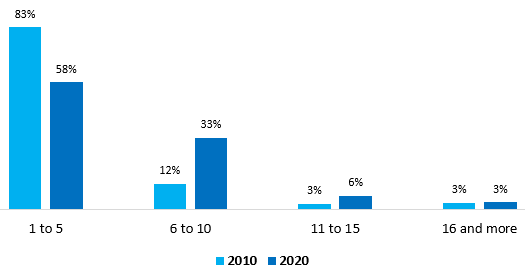

The number of key influencers and decision-makers involved in making a buying decision has increased, on average, to six from four a decade ago.

Small buying teams (one to five decision-makers) have dropped 30 percent while larger buying teams (six to 10 decision-makers) have increased by 175 percent.

How many key influencers/decision makers are involved

in making a buying decision?

The number of key influencers/decision-makers at large vendors has increased over the past decade to better manage the need to evaluate alternative sources, comply with growing regulations, and assess potential societal impacts (such as climate, diversity or children exploitation regulations and concerns).

To meet these functional responsibilities, new positions have been added at the top of organizations, such as VP Regulation, VP Compliance, VP Diversity and VP Digital. Vendors must get in touch all these functions.

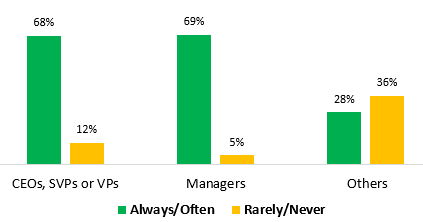

4. Middle management cannot be ignored

The key influencers in B2B sales lie mostly in middle and senior/executive management:

How often do key influencers/decision makers hold the following positions?(Select the frequency: Always, Often, Mixed, Rarely or Never)

As deal sizes increase, decisions have more impact for clients, typically requiring additional expertise and strategic thinking.

To meet purchasing compliance rules and anticipate potential executive turnover, several levels in organizations now commonly participate in the several months’ buying decision process.

5. Transactional Sales are gaining momentum.

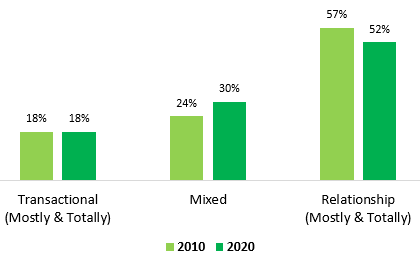

Relationship-driven sales with clients in B2B sales continue to be the most important factor.

Do most of your major clients seem to buy

on a transactional basis or a relationship basis?

Yet, mixed sales have grown 25 percent over the past decade.

The markets keep moving to more competitive pricing and product features. As many disrupted companies are fighting for their short-term survival, this trend likely will only amplify.

Beyond creating human relations with client companies, building B2B relationships is now about framing additional trust and loyalty with all the client stakeholders.

Examples: A better product experience engages more of their customers, unlocking their customers’ more flexible terms and authorizing their customers to take advantage of additional trials without feeling gated; brand develops the company social “raison d’être,” developing customer goodwill.

To address this need, new roles have emerged at the top of organizational charts over the past decade, such as VP Customer Experience, VP Revenue or VP Brand working closely with the B2B sales team.

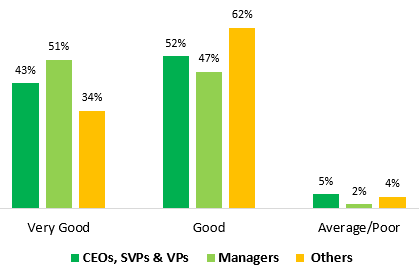

6. Are good relationships good enough?

Executives at vendors were asked to rate their relationships with each level in their client organizations. Over 95 percent of them declare enjoying good and very good relationships at each level. Impressive? Not so sure.

How good is your relationship with

your clients’ key influencers/decision makers?

(Very Good, Good, Average, Poor, Very Poor)

In the multi-sourcing B2B context, having “good” relationships is unlikely to be good enough to secure resilient business against competitors.

Furthermore, these results are the vendors’ perspective and might look slightly different from the client perspective.

Conclusion

Competition is growing with B2B multi-sourcing doubling in only a decade.

B2B buying decisions continue to take eight months, on average, and now involve six decisions makers mostly in middle management and senior/executive management.

Building people relationships at all levels in a client’s organization is pivotal to B2B sales success.

Many thanks to the 400 talented senior executives for sharing their insights on the new environment surrounding high-level B2B sales. We expect you and your team will find this report enlightening.

See more on how these executives build fruitful interactions with their fellow client executives and on how they leverage data analytics and artificial intelligence for their selling activities.

Methodology: This survey is based on responses from 400 executives involved in high- level B2B sales at medium and large companies in February 2020. Their most frequent business titles were CEO, VP Sales, VP Business Development, VP Regions located in the Americas, EMEA and APAC. Click to see the questionnaire and do not hesitate to contact me if you have any questions.