There are 800 million registered companies in the world with one or more employees. That’s an incredibly large number.

Over the years, various stock exchanges, analysts and media outlets have sought to organize these companies into lists based on their various common denominators.

Here is my (arbitrary) selection of what I consider the world’s 12 most prestigious such lists—along with an explanation of the various methodologies used in compiling them. Print or Save in PDF.

Hall of Fame

The 12 selected lists here are listed in alphabetical order: CSI 300, Fortune 500, FTSE 100, Global Forbes 2000, Global Fortune 500, JSE 400, Nikkei 225, Russell 3000, S&P 500, SBF 120, Stoxx Euro 600, and Unicorn.

These 12 lists alone include an extraordinary 5,700 companies. But given that these 5,700 have distinguished themselves among this voluminous number of 800 million companies globally represents quite an accomplishment.

These 5,700 represent one out of 140,000 companies globally—and about 10 percent of them join or fall off of these lists annually based on various eligibility requirements.

The social auras of these lists are hugely impressive.

Just being an employee, a vendor, a customer or an investor in one of them hoists one’s perception as intelligent, successful, and powerful (half joking) in the eyes of most of your friends, family members and (more strategically) even with one’s mother-in-law!

Helicopter view

Each list is managed by an individual company (e.g., the Russell 3000) or by a multi-company partnership (e.g., the S&P 500). Those who manage these lists include media companies (e.g., Fortune magazine), stock exchange operators (e.g., Deutsche Börse) or financial data firms (e.g., the S&P Global).

Their rules for inclusion have been almost unchanged since their creations, spanning between 15 and 69 years ago.

Nine out of 12 lists are stock indexes. Many exchange-traded funds (ETFs) replicate the financial performances of various indices and are available to investors. Since their emergence, they have been brought even greater levels of investment and attention to the companies that comprise them.

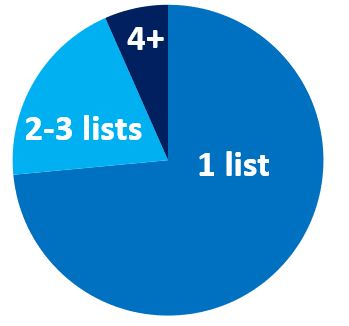

Limited overlaps. 73 percent of the companies appear only in a single list, 7 percent appear in four or more lists and one single company (Merck) appears on six lists.

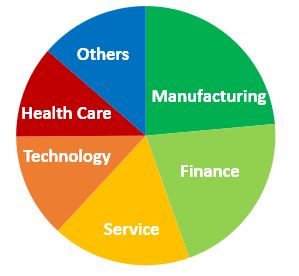

The industries most represented among these lists are in the following industry sectors: Manufacturing, Finance, Service and Technology.

Iconic Fortune 500 Lists

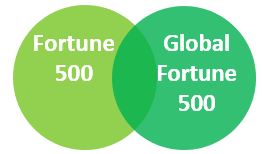

Fortune magazine has created two iconic lists published annually. They both rank by revenue 500 private and publicly-listed companies.

The U.S. company ranking is named the Fortune 500 (US 500). The global company ranking is named the Global Fortune 500 (Global 500).

In fiscal year 2018 (reported in 2019), the 500th company on these two lists generated, respectively, $5.6 billion (US 500) and $24.8 billion (Global 500) in annual revenue.

24 percent of the companies represented on the Fortune 500 and Global Fortune 500 belong to both lists. With the growing number of China and India-based companies entering the Global 500, however, this number has been declining.

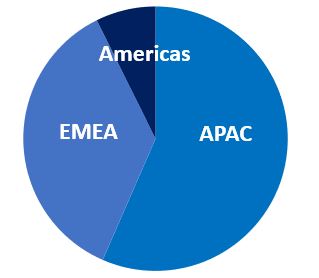

Among companies based outside of the U.S. in the Global 500, 57 percent are based in APAC (Asia Pacific) and 36 percent are based in EMEA (Europe Middle East and Africa).

S&P 500 and Russell 3000

The S&P 500 and the Russell 3000 are two very famous capitalization-weighted stock market indices. They both track large U.S.-listed companies. They cover, respectively, 80 percent and 98 percent of the U.S. equity market.

The Russell 3000 lists the 3,000 largest U.S. companies by market capitalization. The index is compiled by FTSE Russell, a subsidiary of LSE Group.

S&P 500 stocks represent the 500 largest companies ranked by market capitalization. The list is comprised and managed through a joint venture comprising S&P Global, CMR Group and News Corp.

The S&P 500 also has become a meaningful list commonly used as a benchmark for the stock performance of mutual funds. Over time, less than one percent of some 20,000 available mutual funds have beat the S&P 500’s stock performance net of management and other fees.

That the S&P 500 has performed so exceptionally on a relative basis has become another testament to the elite nature of the list.

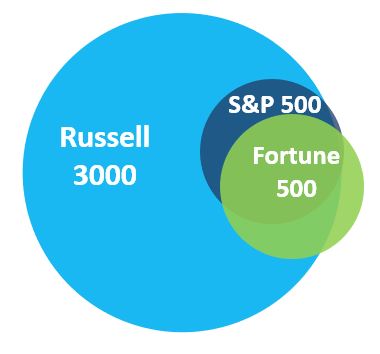

The following graphic (below) represents the respective members of the Russell 3000, S&P 500 and Fortune 500 proportionate to their representation in each grouping:

Overlaps. Out of 500 companies in the S&P 500, 97 percent are also in the Russell 3000. Out of 500 companies in the Fortune 500, 90 percent are also in the Russell 3000.

Over 300 companies belong to all three lists; among these 300 are the world’s three largest companies by market capitalization: Microsoft, Apple and Amazon.

Global Lists

Developing and managing global lists remains a challenge. Reason: The financial content disclosures differ by geographies.

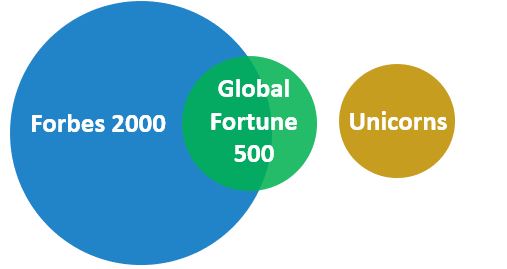

One of the most comprehensive global lists is the Global Forbes 2000 (Forbes 2000). Using data from FactSet Research, Forbes magazine ranks publicly-traded companies by equally-weighting their revenue, profits, assets and market value.

In fiscal year 2018 (as reported in 2019), 97 percent of the Global 2000 companies generated over $1 billion in annual revenue.

The Unicorn list (assembled by The Official Board) displays the privately-held startup companies valued at over $1 billion by one of the 200 largest venture capital firms. These 400+ unicorn companies receive considerable media attention and talent traction.

Even if some unicorn valuations may have been inflated to meet the magic $1 billion threshold, $1 billion continues to be a compelling benchmark to track the most promising private startups.

Regional Stock Indices

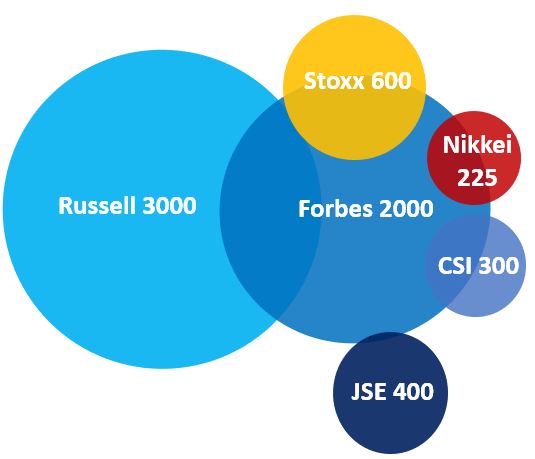

The graphic below displays how five famous regional stock indexes intersect with the Global Forbes 2000:

Looking at the U.S., 20 percent of the companies in the Russell 3000 are also in the Forbes 2000.

Continuing clockwise, the Stoxx Euro 600 (Stoxx 600), compiled by a Deutsche Börse German subsidiary, contain 600 large and mid-sized capitalization companies coming from 17 European countries. 58 percent also are part of the Forbes 2000.

The Nikkei 225, compiled by the Nihon Keizai Shinbun, contains 225 large, publicly-owned companies of the Tokyo Exchange since 1950. 59 percent also are part of the Forbes 2000.

The CSI 300, compiled by the China Securities Index Company, contains the 300 largest capitalization companies traded on the Shanghai and Shenzhen stock exchanges. 49 percent of these 300 companies are also part of the Forbes 2000.

The JSE 400, compiled by the Johannesburg Stock Exchange, contains several hundred medium and large capitalization companies based in Africa. Six percent are also part of the Forbes 2000.

In Europe, the FTSE 100, compiled by an LSE Group subsidiary, contains the 100 largest capitalized companies traded on the London Stock Exchange.

The SBF 120, compiled by Euronext,contains the 120 most actively traded stocks listed in Paris, including the entire CAC 40.

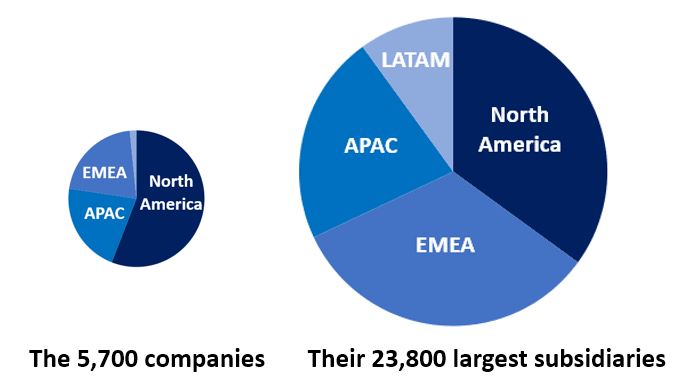

Locations

The 5,700 companies comprising these prestigious lists are mostly (56%) located in North America. Their 23,800 largest subsidiaries are divided between North America (35%), EMEA (33%), APAC (22%) and LATAM (10%).

The distributions are different because many U.S. companies have established many product and geographic subsidiaries in Europe and Latin America.

Take-Aways

Whether you are an investor, a recruiter or a vendor, when consulting these 12 selective lists, you sip the “crème de la crème”: the best among the best companies.

Click here to view their lists (free) and schedule monthly email alerts (also free) to learn about their main executive hires globally! Additional data is available and downloadable for individual and corporate users.

To learn more, please contact us at: [email protected].We hope that you will fall in love as we have with the amazing companies that comprise these 12 impressive lists.